-

- NASDAQ: CCLD $2.45

- 1-877-342-7517

Managing the revenue cycle is a critical aspect of any healthcare practice. Investing in a reliable Revenue Cycle Management (RCM) software solution is essential to optimize efficiency, accuracy, and financial performance. Investing in a reliable RCM software solution is crucial for streamlining revenue cycle processes and ensuring financial success in your healthcare practice. Consider these top six RCM software solutions and choose the one that aligns with your practice’s needs and goals.

Regarding Revenue Cycle Management (RCM) solutions, choosing the right one that aligns with your organization’s needs and goals is essential. Here is a comparison of the top six RCM software solutions in the market. By comparing these top RCM software solutions, you can evaluate their features, benefits, and suitability for your organization’s specific requirements. Consider factors like functionality, scalability, integration capabilities, and user-friendliness to make an informed decision that will streamline your revenue cycle operations and drive financial success.

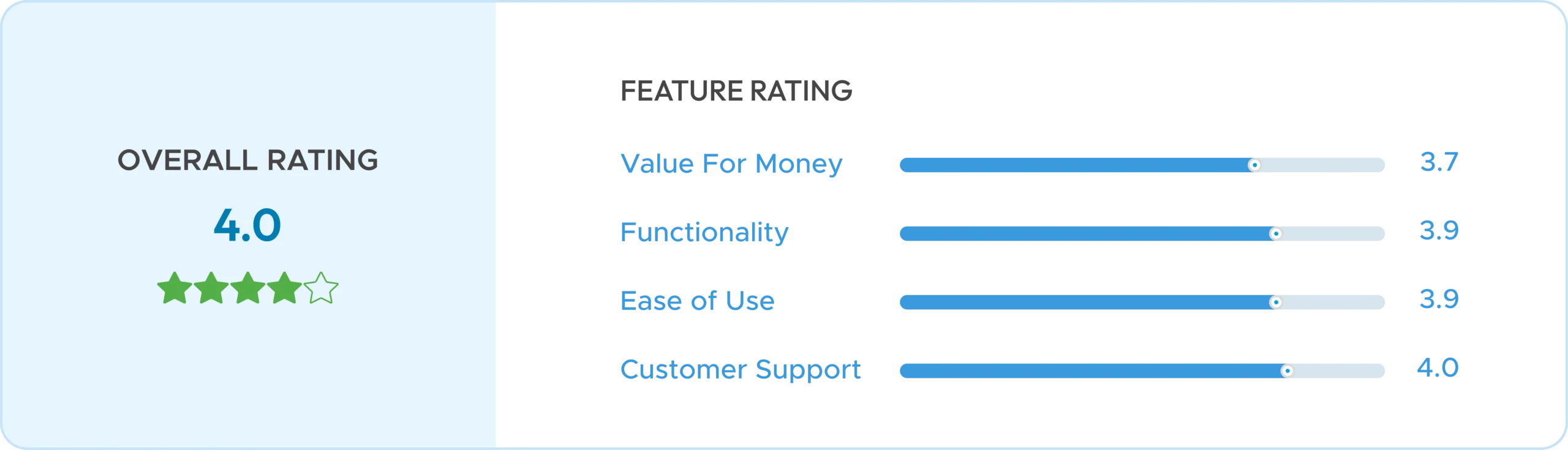

CareCloud (NASDAQ: CCLD) is a leading provider of cloud-based healthcare technology, serving over 40,000 providers across 70+ specialties with AI-driven solutions for revenue cycle management (RCM), EHR, practice management, and patient engagement. Founded in 1999 in New Jersey, the company launched its cirrusAI suite in July 2023 and was named a “Top Healthcare IT Pick” in 2025 by Maxim Group.

Its AI Center of Excellence aims to scale to 500 AI professionals, reinforcing its leadership in applied healthcare AI. In Q1 2025, CareCloud reported $27.6M in revenue (up 6% YoY), $1.9M in net income, and $5.6M in adjusted EBITDA (52% growth). Annual guidance projects $111–$114M in revenue and $26–$28M in EBITDA. Its tiered pricing includes Central ($349/month), Complete ($629/month), and Concierge (3%–7% of collections), with features ranging from claim scrubbing to full RCM outsourcing.

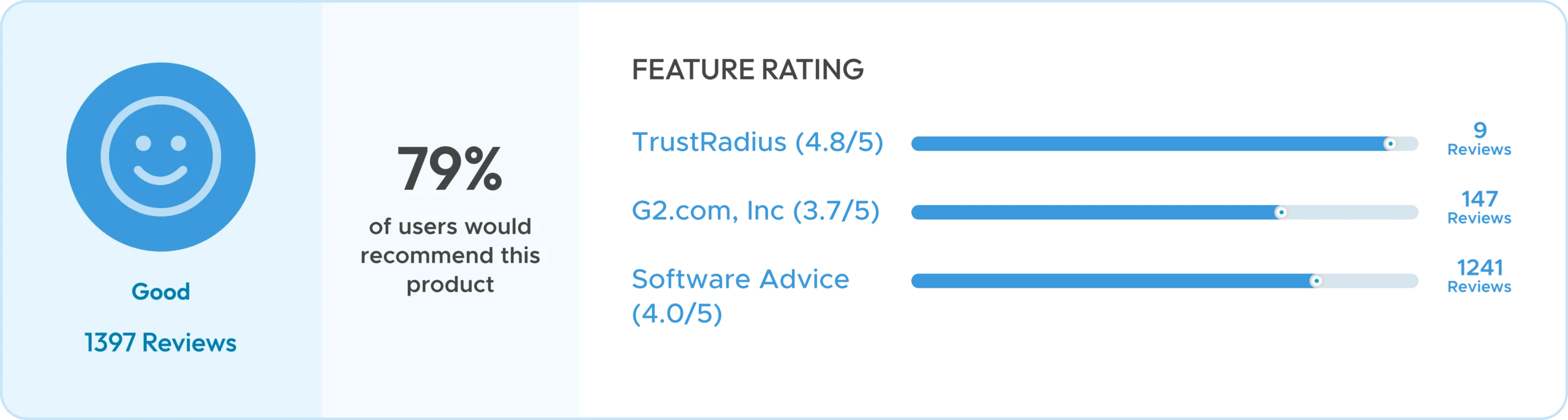

Waystar (NASDAQ: WAY) is a cloud-based healthcare payment software provider founded in 2017 in Lehi, Utah, serving over 30,000 clients, including 16 of the top 20 U.S. News Best Hospitals, and over 1 million providers. Its AI-driven platform processes $1.8 trillion in annual claims, covering 50% of U.S. patient volume, with a focus on end-to-end RCM, denial prevention, patient payments, and analytics.

In Q1 2025, Waystar reported $256.4 million in revenue (up 14% YoY), $29.3 million in net income (vs. a $15.9M loss in Q1 2024), and $107.7 million in adjusted EBITDA (42% margin). The 2025 outlook includes $1.006–$1.022 billion in revenue and $406–$414 million in EBITDA. Pricing is custom-based, with base platform subscriptions starting around $50,000/year and enterprise solutions exceeding $100,000/year. Additional AI modules, like AltitudeAI, are offered as premium add-ons.

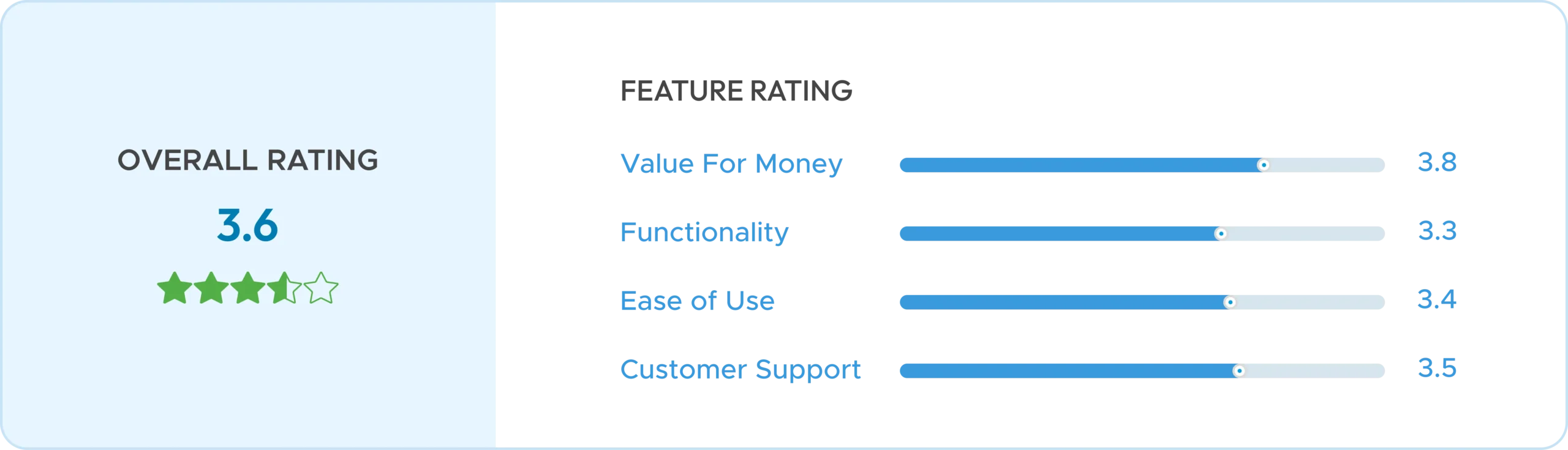

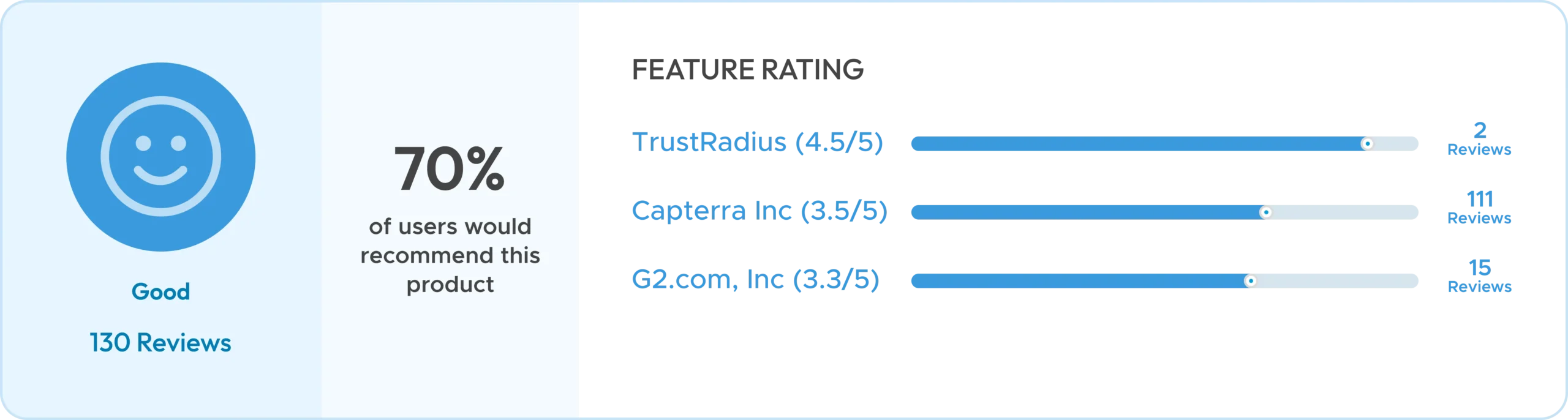

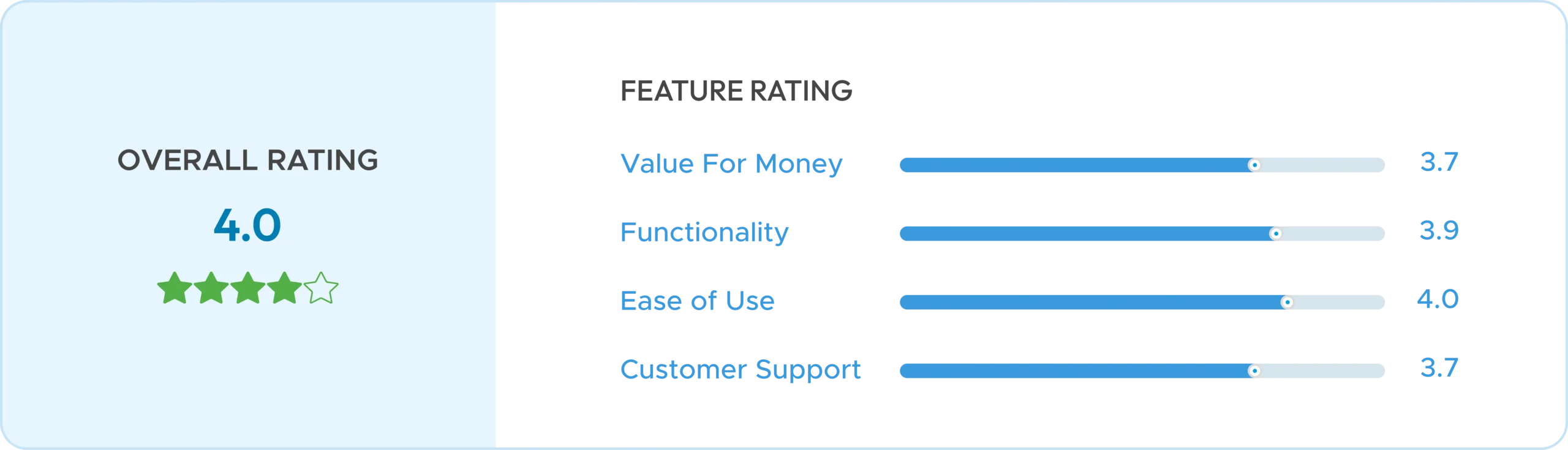

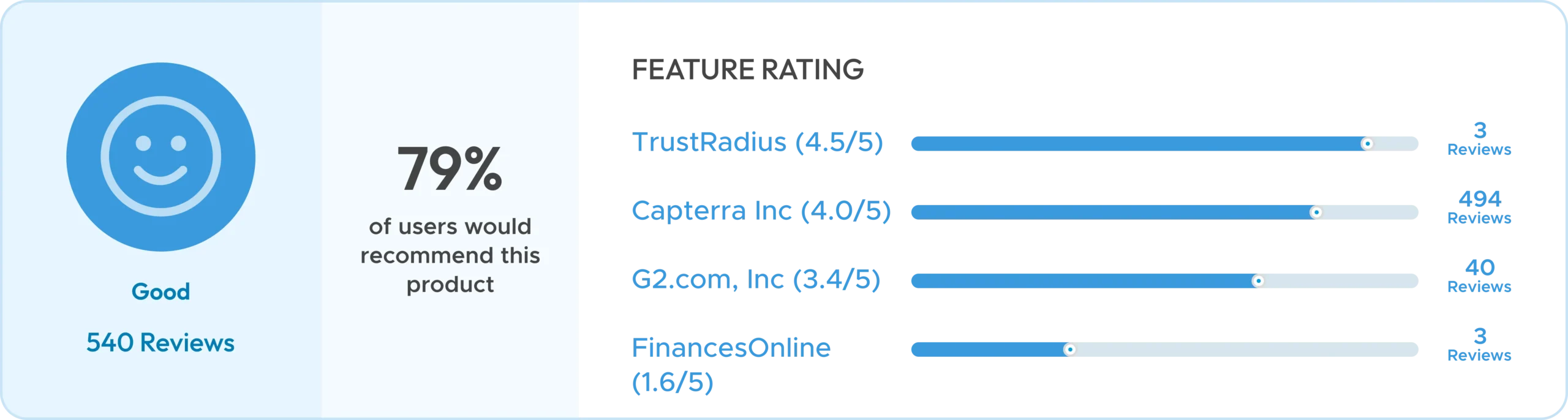

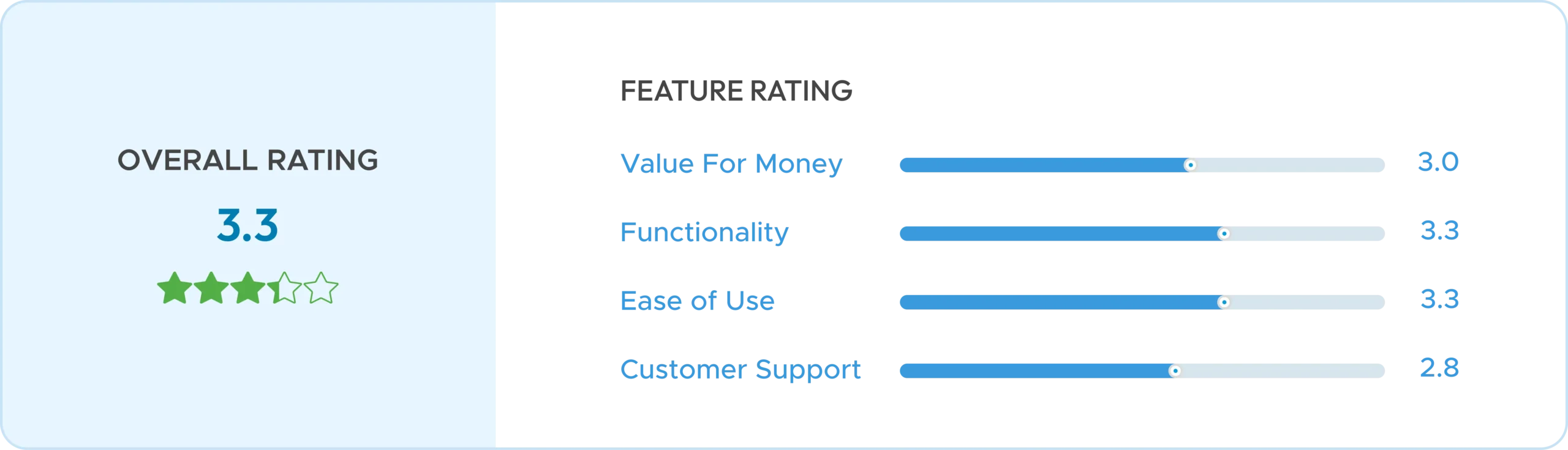

DrChrono is a cloud-based healthcare tech company founded in 2009 in Sunnyvale, California. It offers an all-in-one platform for EHR, practice management, billing, and RCM, optimized for Apple devices and used by over 17.8 million patients across 20+ specialties. With a strong focus on mobile-first design, its 2025 updates include AI voice recognition, FHIR interoperability, and specialty-specific workflows.

The company processes over $3 billion in annual claims and has seen growth through expanded RCM services and a 40% increase in telehealth adoption since 2023. DrChrono offers four custom-priced plans, Prometheus, Hippocrates, Apollo, and Apollo Plus, catering to practices of all sizes, all of which include telehealth, patient portals, and scheduling, with free implementation for paid users.

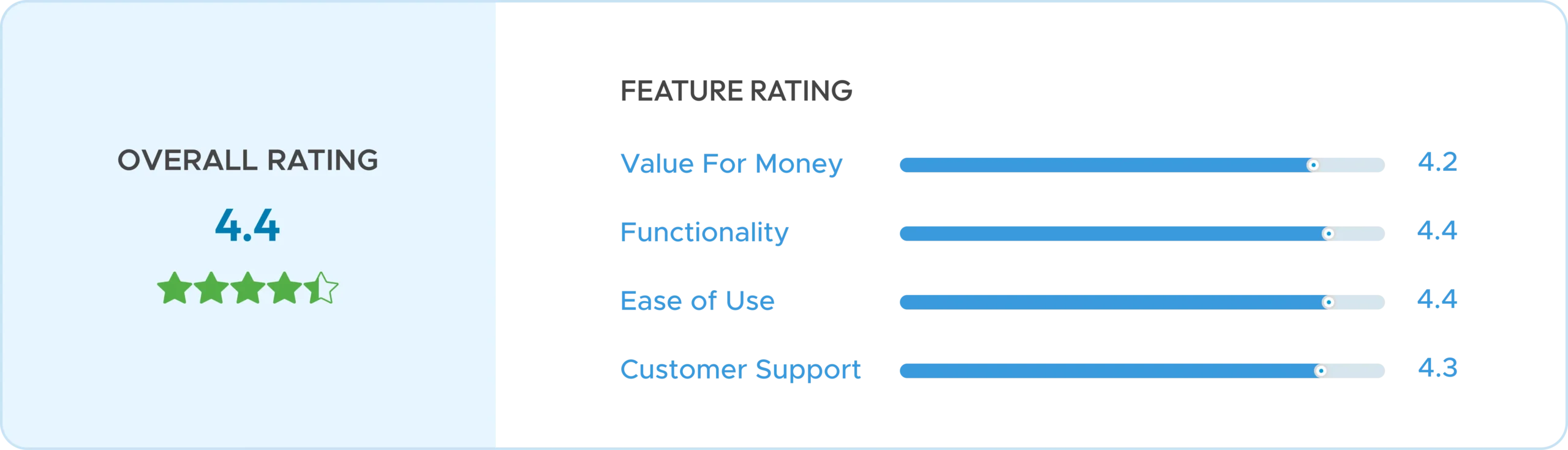

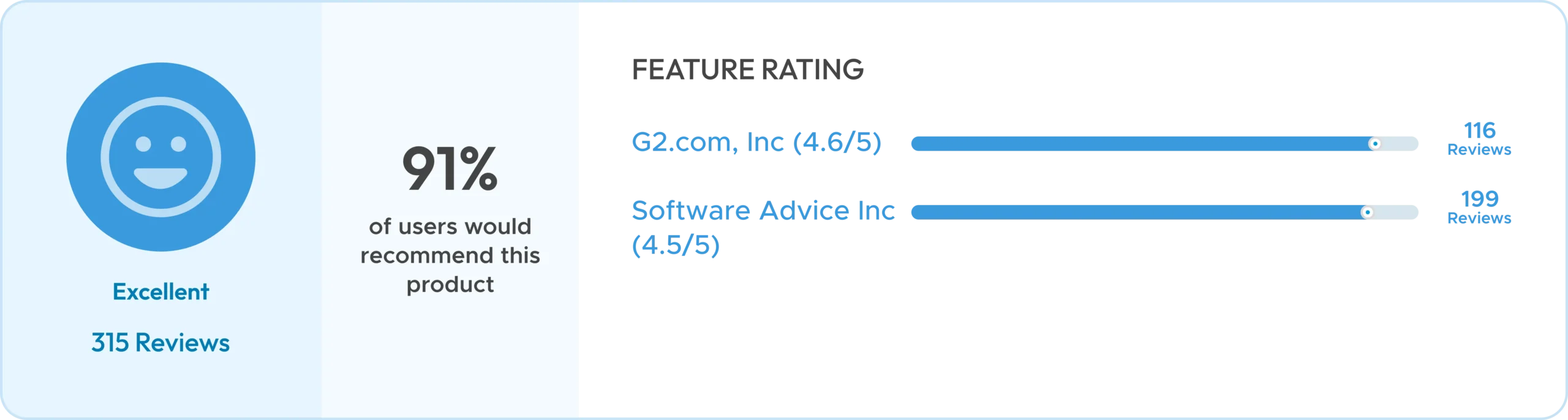

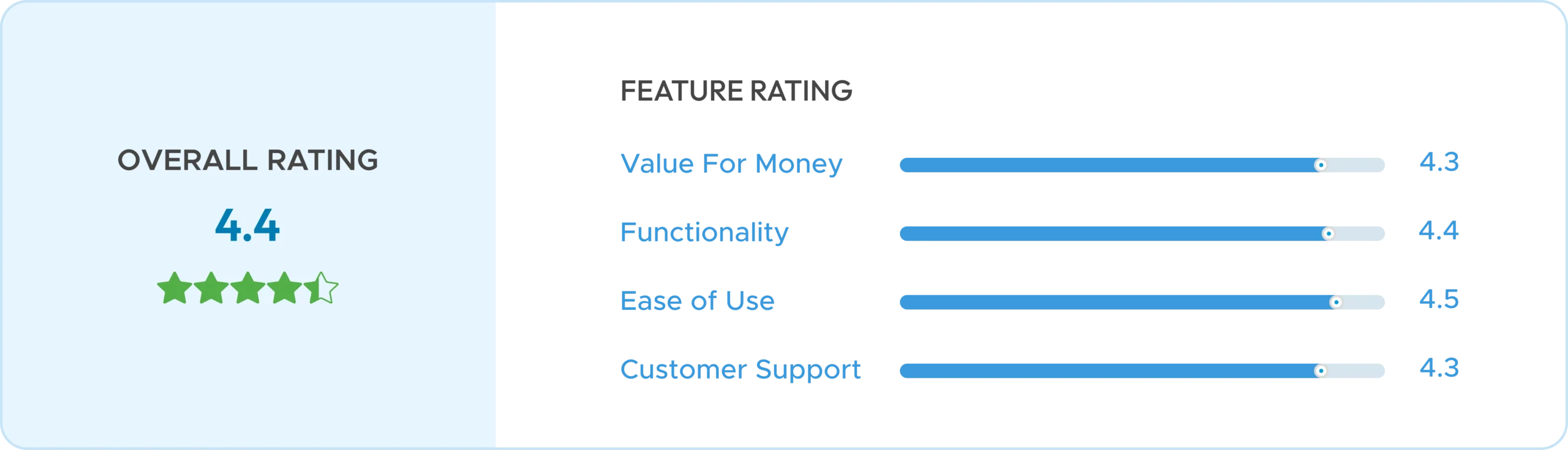

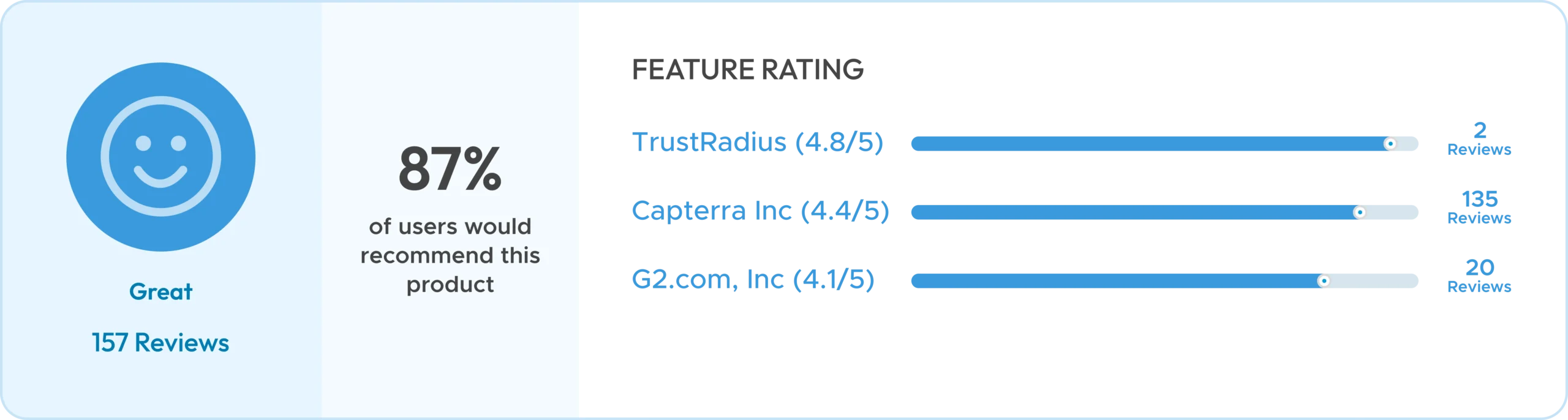

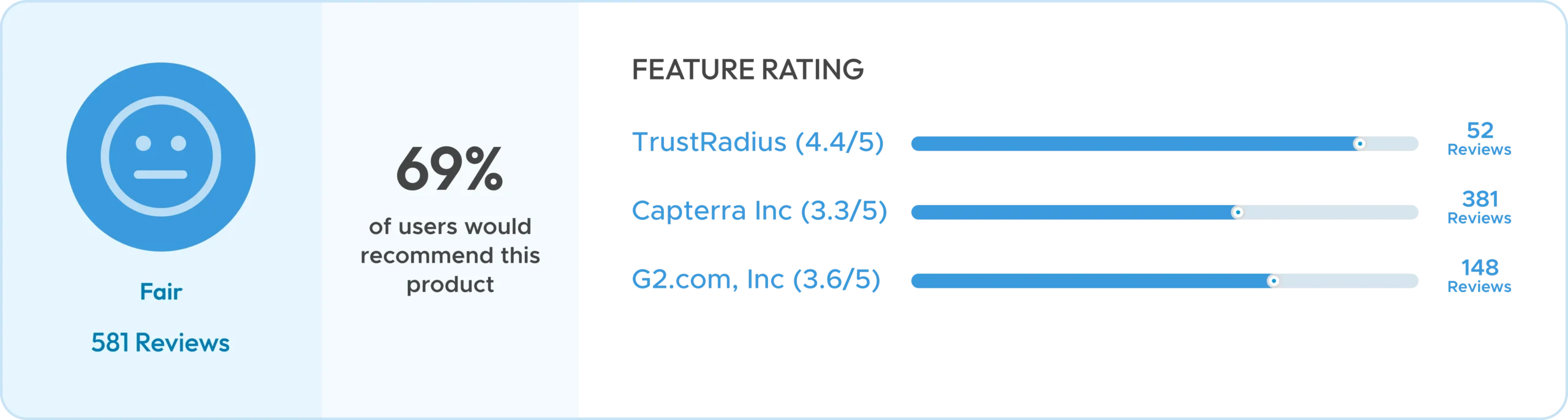

ModMed (Modernizing Medicine), founded in 2010 in Boca Raton, Florida, is a healthcare SaaS company offering AI-powered, specialty-specific solutions for EHR, practice management, RCM, and patient engagement. Serving over 40,000 providers across 11+ specialties like dermatology and ophthalmology, its flagship EHR, EMA®, includes features like ambient AI (ModMed Scribe™) and Apple device compatibility.

Backed by Clearlake Capital as of March 2025, ModMed has achieved four straight profitable quarters and processed $1.8 billion in collections through its BOOST RCM service. Pricing is customized based on practice size and specialty, with free implementation for paid plans. Core offerings include EMA Core for small practices, EMA Plus for mid-sized clinics, and BOOST RCM for large groups, with optional add-ons like AI tools, marketing modules, and ModMed Pay.

NextGen Office is a cloud-based EHR and practice management solution tailored for small practices (1–10 providers), developed by NextGen Healthcare, formerly Quality Systems, Inc. (founded in 1974, headquartered in Atlanta, Georgia, U.S.). It offers integrated EHR, PM, RCM, and AI-powered tools like NextGen Ambient Assist for automated note-taking, with a focus on specialty-specific workflows (e.g., pediatrics, internal medicine) and interoperability through FHIR/HL7.

After Thoma Bravo’s $1.8 billion acquisition in 2023, NextGen became a private company, no longer disclosing financials, though pre-acquisition, it processed over $3 billion in claims and supported 124,000+ providers. Growth continues through AI adoption, with Ambient Assist saving providers up to 2.5 hours daily, and top EHR rankings in multiple specialties. Its 2025 pricing model includes a base subscription ($299–$499/provider/month), optional RCM services (3–7% of collections), and an AI add-on ($100–$150/provider/month), with free setup and training under contracts typically spanning 3–5 years.

eClinicalWorks (eCW) is a privately held healthcare tech company founded in 1999 in Westborough, Massachusetts, known for its cloud-based EHR, practice management, RCM, and AI-powered tools. It supports over 180,000 physicians and 850,000 healthcare professionals at 110,000+ facilities worldwide, focusing on ambulatory care, urgent care, and specialty practices. Its V12 + AI platform includes tools like Sunoh.ai and Image AI, offering advanced interoperability and patient engagement features.

In 2024, eCW generated $1 billion in revenue, with growth fueled by AI adoption, cloud migration to Microsoft Azure, and strong RCM performance (98%+ first-pass claim rate). Pricing is tiered: $449/month for EHR, $599/month with practice management, and 2.9% of collections for full RCM services. Add-ons like AI tools and the healow® Genie contact center are available, and implementation is free for small practices.

The global market for healthcare RCM outsourcing is expected to grow significantly, from 23.7 billion USD in 2022 to 62.40 billion USD by 2028 (CAGR of 17.4%). A thorough evaluation is essential to selecting the best RCM software provider. Before choosing a Revenue Cycle Management software provider, healthcare providers can consider the following factors.

CareCloud has been providing revenue cycle management services for over ten years. Our experience and expertise in the healthcare industry have allowed us to develop a comprehensive and effective RCM solution

We’re Here to Help

Our experts are ready to assist

you in real-time.